Designing Innovation Ecosystems Part 2: Adventure Capital

This is the second installment in our ongoing series on designing innovation ecosystems. If you missed the first installment, regarding failure tolerance, you can find it here.

Over the series, we will explore:

- Failure tolerance

- Risk capital

- Labour market liquidity

- Innovation policy

- Ecosystem strategy

This week, we delve into the emollient of innovation ecosystems: risk capital.

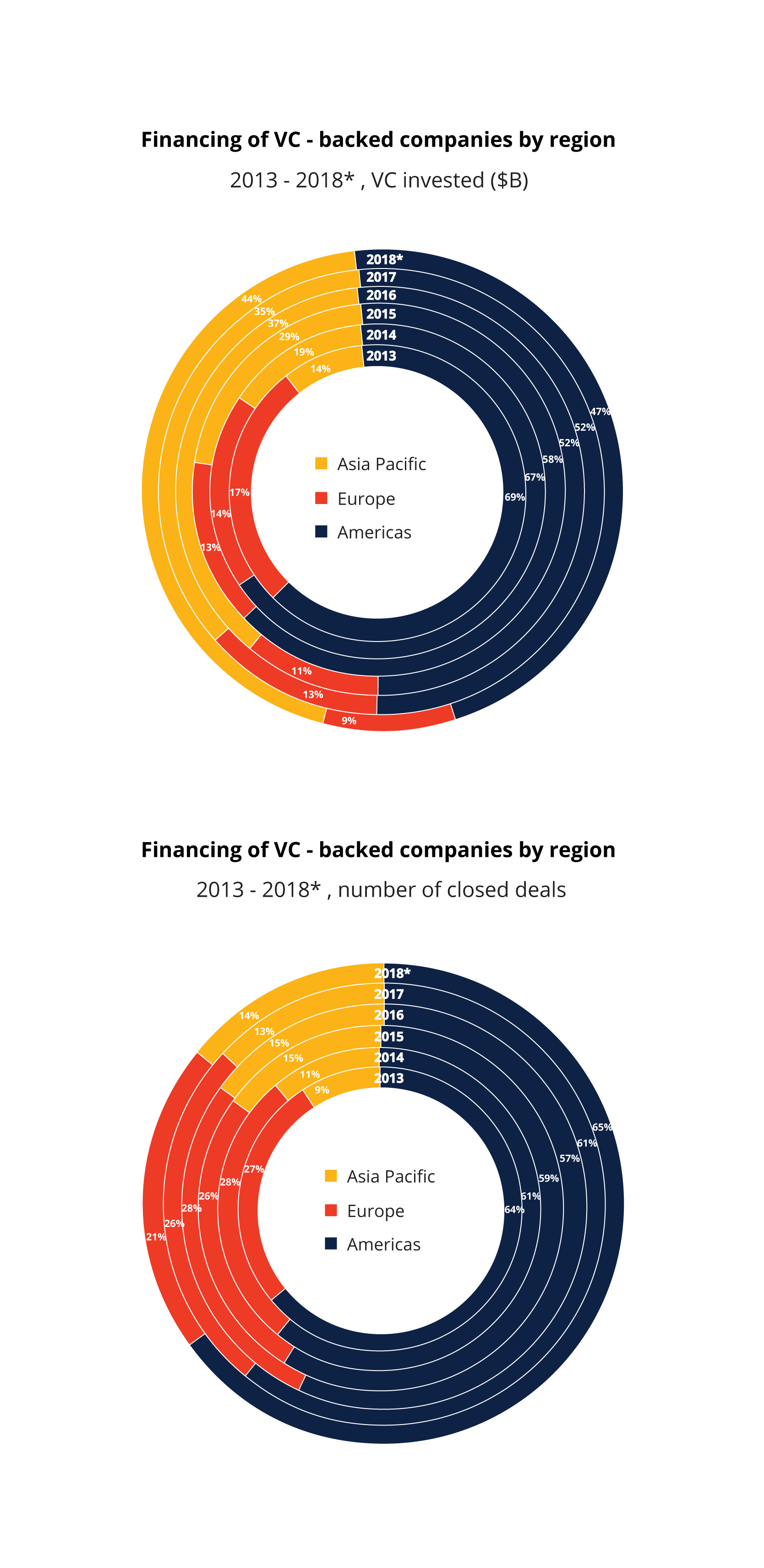

It behooves us to examine the concentration of risk capital today. Here’s an analysis of venture capital finance by region by KPMG:

As you can see, deal volume (on the right) has remained relatively constant, with 65% of deals in the Americas, 21% in Europe, and 14% in Asia. Transaction value has leapt in Asia with several “mega-deals” like Ant financial, but the number of deals has been pretty steady in terms of regional distribution for the past several years. And within the Americas, for example, more than half of the funding is in a single state: California.

The numbers don’t tell the whole story: it’s extraordinarily difficult for a non-Chinese company to break into the PRC market, so while there is unprecedented deal value being executed in mainland China, it’s almost irrelevant to entrepreneurs in the other 194 countries in the world.

The China miracle does offer some interesting lessons for other governmental regions, but also is so idiosyncratic that it cannot simply be replicated wholesale (any more than Silicon Valley can be recreated). A few relevant observations:

- Government support for entrepreneurship

- State-sponsored investment in entrepreneurial education

- Permissive business rules to enable the accumulation of entrepreneurial wealth

- A well-educated workforce

Although I don’t personally endorse the attitude I have heard from many Chinese entrepreneurs and companies with regards to intellectual property, great respect must be paid to the tremendous wealth creation we have seen over the past 30 years due to entrepreneurial spirit, drive, and fortitude.

According to financial innovation connector extraordinaire Misha Rao, more than 65 governments are trying to create regional innovation clusters just in the world of fintech – and more if we include fields like biotech, agtech, energy, artificial intelligence, and additive manufacturing. So with all of this action, where’s the money to fund it?

Europe is grappling with the issue that 70% of its corporate finance is today funded by bank loans – which by their very nature are risk-averse, thus stifling the financing of innovation. How can more venture capital be injected into the system?

The MENA region is a curious paradox. I have met many family offices (and sovereign funds) that are glad to invest as limited partners into US and European/UK venture capital funds… but not put venture to work in the region.

What steps can government take, to accelerate the development of risk capital pools in markets outside San Francisco or Shanghai?

Here are a few tools I can point to, modelled on programmes in the US that have been replicated elsewhere (CORFO out of Chile comes most notably to mind).

-

Government-enhanced equity capital: while I don’t endorse the idea of a government venture capital fund, I do think that if government provides low-interest, non-recourse loans to venture capitalists, it can accelerate the development of new funds. For example, the fund manager puts up 20% or 30% of the money, and takes the “first loss” position, but in turn gets the ability to invest 3x to 5x as much money thanks to these government-supported loans.

-

Capacity building for investors: governments can fund educational programmes to bring best practices of professional venture investing to a new market, that may lack such expertise. Government support could even provide for an apprenticeship-style model (similar to the old Kaufmann Fellows program in the US) where aspiring venture capitalists could have a subsidised internship at an established VC fund.

-

Tax incentives: offering incentives to investors who create long-term value through private investments is another tool which I support.

Of course, these venture capitalists need entrepreneurs to invest in. And those entrepreneurs (who create 4 out of 5 new jobs), need people they can hire. In our next instalment in this series, we will talk about labour market liquidity.

The views expressed in this column are those of David Shrier, and may not reflect those of Saïd Business School, University of Oxford or its faculty.