Blockchain’s Effect on Business

Blockchain could have revolutionary implications for the future of business operations. From accounting to operations, the growing consensus among industry leaders is that it’s likely to impact every major area of work – and the shift is already starting.

In fact, blockchain has the potential to add $1.76 trillion to the global economy by 2030. 1

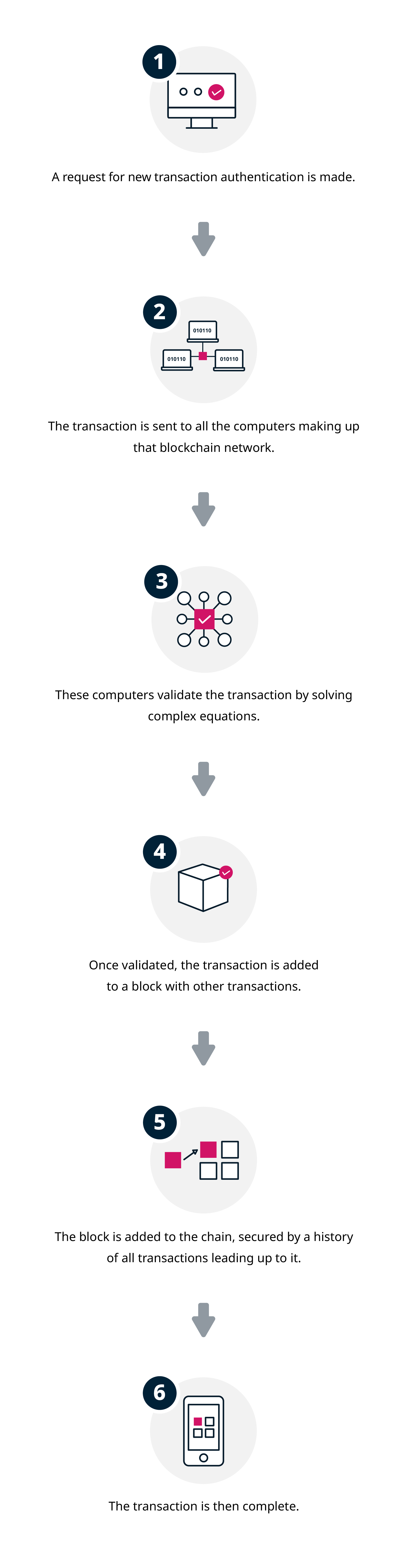

The technology automatically tracks transactions from start to finish without having to consult a central authority tasked with preserving the transaction or encrypting the data, and without the need for human intervention. Instead, by compartmentalizing them, blockchain provides transparency around what’s occurred in the history of the transactions. Moreover, because blockchain is unchangeable, this information is secure.2

This ‘digital ledger’ allows innovators and disruptors to flip the script on typical organizational processes in various exciting ways. Take a look at some of the business applications:

Asset protection

Global cybercrime damages are predicted to total $6 trillion in 2021, and this figure is expected to rise to $10.5 trillion annually by 2025.3 Cybercrime is big business, but blockchain could bring some relief.

Innately transparent, immutable, and decentralized, the technology bestows greater transactional security. Blockchains store data using sophisticated math and software rules that are almost impossible for attackers to manipulate. Each block added onto the chain carries a hard, cryptographic reference to the previous block. This reference is part of a complicated mathematical problem that must be solved to bring the subsequent block into the network and chain. The process creates a uniquely encrypted digital fingerprint called a hash that’s secure and highly tamper-resistant.4

However, despite its many advantages, blockchain isn’t a silver bullet for preventing cybercrime. Blockchains, unfortunately, still run on operating systems that have exploitable vulnerabilities. To mitigate end-user vulnerabilities, organizations must therefore ensure their external data sources are secure, as these fall outside blockchain’s ambit.5

Cutting out the middleman

Professionals working in banking, contracts, settlements, or any business process that involves being a third party to a transaction may be affected by the increasing adoption of blockchain.

Blockchain cryptology replaces third-party intermediaries as the keeper of trust. By using mathematics instead of intermediaries, blockchain can help reduce overhead costs and hassles for companies or individuals when trading assets.6

If you work in this field, it would be wise to arm yourself with an in-depth understanding of cryptocurrency assets, which are created, stored, transferred, and verified on blockchain, to harness the potential they offer.

Lowering operating expenses

Blockchain allows businesses to send and receive payments through programmatic sets of rules called ‘smart contracts’. These contracts are programmed onto a blockchain and, when a predetermined condition is met, the smart contract triggers the next appropriate action automatically. This process removes the need for brokers, escrow agents, and other financial intermediaries. In addition, the blockchain is updated when the contract is fulfilled and the transaction cannot be altered.7

As all actions related to a particular smart contract are transparent and recorded, the technology typically reduces the cost of tracking and reconciliation. This is promising for global corporations, as basic administrative functions such as payroll management can be executed seamlessly across different countries. In the context of an increasingly decentralized global workforce, this will only become more and more relevant.

By establishing irreversible and enforceable rights and responsibilities for all parties involved, smart contracts can also help facilitate the employment of the world’s roughly 1.7 billion people who don’t bank with a recognized financial institution. Moreover, both employer and employee would benefit by conducting payment in a universally acknowledged cryptocurrency, which is transferred directly to the individual rather than through an intermediary third party.8

Supply chain tracking

Business owners often don’t have oversight of all the roleplayers along the supply chain, but blockchain technology creates greater transparency. For example, in the food industry, it’s imperative to have solid records that trace each product to its source in case something goes wrong. Walmart, for example, has partnered with the IBM Food Trust on a project that uses blockchain to keep track of fresh produce and other foods.9 Walmart Canada deployed a blockchain supply chain and invoice platform to manage half a million shipments annually, reducing shipping discrepancies by 97 percent.10

Bringing transparency into the supply chain also helps verify points like the authenticity of parts and ethical sourcing. A company can also provide digitally permanent, auditable records for stakeholders and investors by harnessing blockchain technology. Transparent, efficient audits are one of the most common ways of improving supply chain execution.11

New possibilities for blockchain in business

Blockchain is the backbone that allows cryptocurrency transactions to occur, and the technology is finding its way into countless facets of our professional and personal lives. Other applications include processing insurance claims, virtual litigation, tracking environmental, social and corporate governance, air traffic control for drones, and increasing the efficiency of foreign exchange flows.12 It’s a brave new world of endless possibilities for businesses that are willing to embrace the technology.

Learn more about the business applications with the MIT Sloan School of Management’s Blockchain Technologies: Business Innovation and Application online short course. This six-week course equips professionals with tools to drive innovation and efficiency through blockchain technologies. Read more about what you can expect on the course here.

Alternatively, you can participate in the Blockchain and Digital Currency: The Future of Money online short course from the University of Cape Town. Over six weeks, you will gain a deeper understanding of how blockchain works in the current and future financial system.

In addition, the SDA Bocconi School of Management offers the five-week Bitcoin and Blockchain Program, which provides insights into the practical applications of blockchain to unlock new business opportunities.

- 1 (Oct, 2020). ‘Time for trust: The trillion-dollar reasons to rethink blockchain’. Retrieved from PWC.

- 2 Ryan, J. (Jul, 2021). ‘Who writes the rules of a blockchain?’. Retrieved from Harvard Business Review.

- 3 Morgan, S. (Jan, 2021). ‘2021 report: Cyberwarfare in the C-suite’. Retrieved from Cybersecurity Ventures.

- 4 Clark, M. (Sep, 2021). ‘Blockchain, explained’. Retrieved from The Verge.

- 5 Benjamin, N. (Jul, 2021). ‘Is blockchain the ultimate cybersecurity solution for my applications?’. Retrieved from ISACA.

- 6 Ryan, J. (Jul, 2021). ‘Who writes the rules of a blockchain?’. Retrieved from Harvard Business Review.

- 7 (Nd). ‘What are smart contracts on blockchain?’. Retrieved from IBM. Accessed 9 November, 2021.

- 8 Zamagna, R. (Apr, 2021). ‘The future of HR belongs to blockchain technology. Part 1 – the disintermediation’. Retrieved from Data Driven Investor.

- 9 Gaur, V. and Gaiha, A. (Jun, 2020). ‘Building a transparent supply chain’. Retrieved from Harvard Business Review.

- 10 Shein, E. (Sep, 2020). ‘Walmart Canada IoT-blockchain system nearly eliminates shipping discrepancies’. Retrieved from TechRepublic.

- 11 Gaur, V. and Gaiha, A. (Jun, 2020). ‘Building a transparent supply chain’. Retrieved from Harvard Business Review.

- 12 Del Castillo, M. (Feb, 2021). ‘Blockchain 50 2021’. Retrieved from Forbes.