How to Do a Financial Analysis When Managing a Project

A project manager’s core function is to successfully execute a project within the estimated budget, time, and scope of the project.1 Where time and scope may be of equal importance in the life cycle of a project, everything hinges on the availability and good governance of finances, and that requires a well-executed financial analysis by the project manager.

When project managers carry out a financial analysis, they do so to ascertain whether a project will be a profitable undertaking and would warrant financial investment.2 Financial analysis is not only to be done in the planning stages of a project, but throughout every stage of the project. It remains within the purview of the project manager to be up-to-date with the project’s finances based on the initial estimates, and to keep an eye on it throughout the duration of the project.3

Before starting a new project, carrying out a proper financial analysis is vital to determining whether the project will be financially viable or not. There are several ways to determine this.

Start with a cost benefit analysis

Cost benefit analysis (CBA) in project management is the evaluation of the cost versus the benefits of the proposed project.4 It also offers a baseline on which to compare projects and evaluate which have greater benefits than costs, in order to know which to pursue.

By listing every expected project expense and the anticipated benefit, a project manager can calculate the following:

- Return on investment (ROI).5 This compares the profit value that can be earned from a project against the cost of investment, as a percentage value. The higher the percentage, the better the ROI

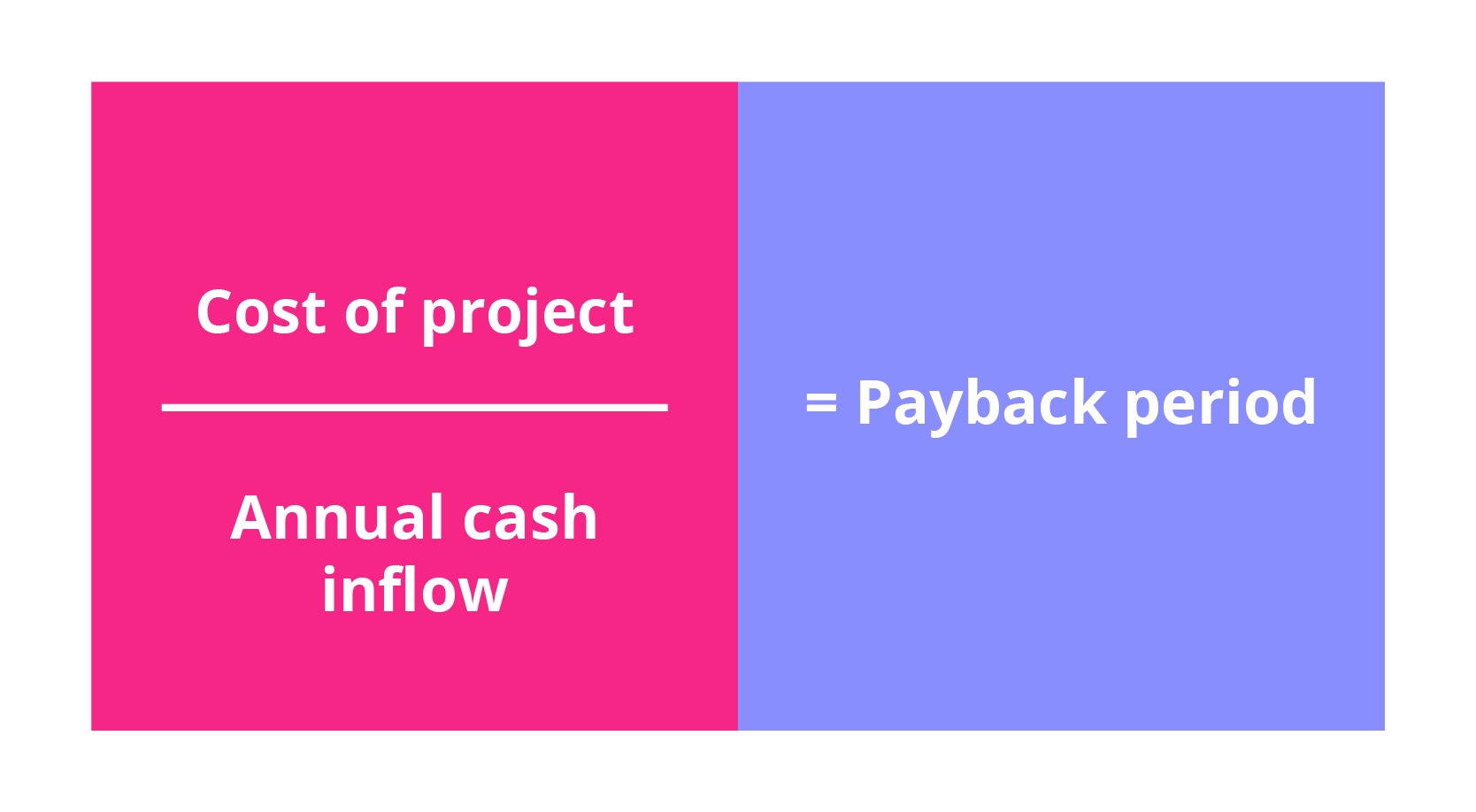

- Payback period analysis.6 This is the simplest way of looking at one or more project ideas, as it calculates how long it will take to earn back the project capital. This is calculated as follows: Cost of project divided by annual cash inflow equals payback period

- Accounting rate of return (ARR).7 ARR provides a quick estimate of the project’s net profits based on its entire lifespan, and gives a basis for comparing several different projects. This can be calculated as follows: ARR equals annual cash inflows minus depreciation initial investment

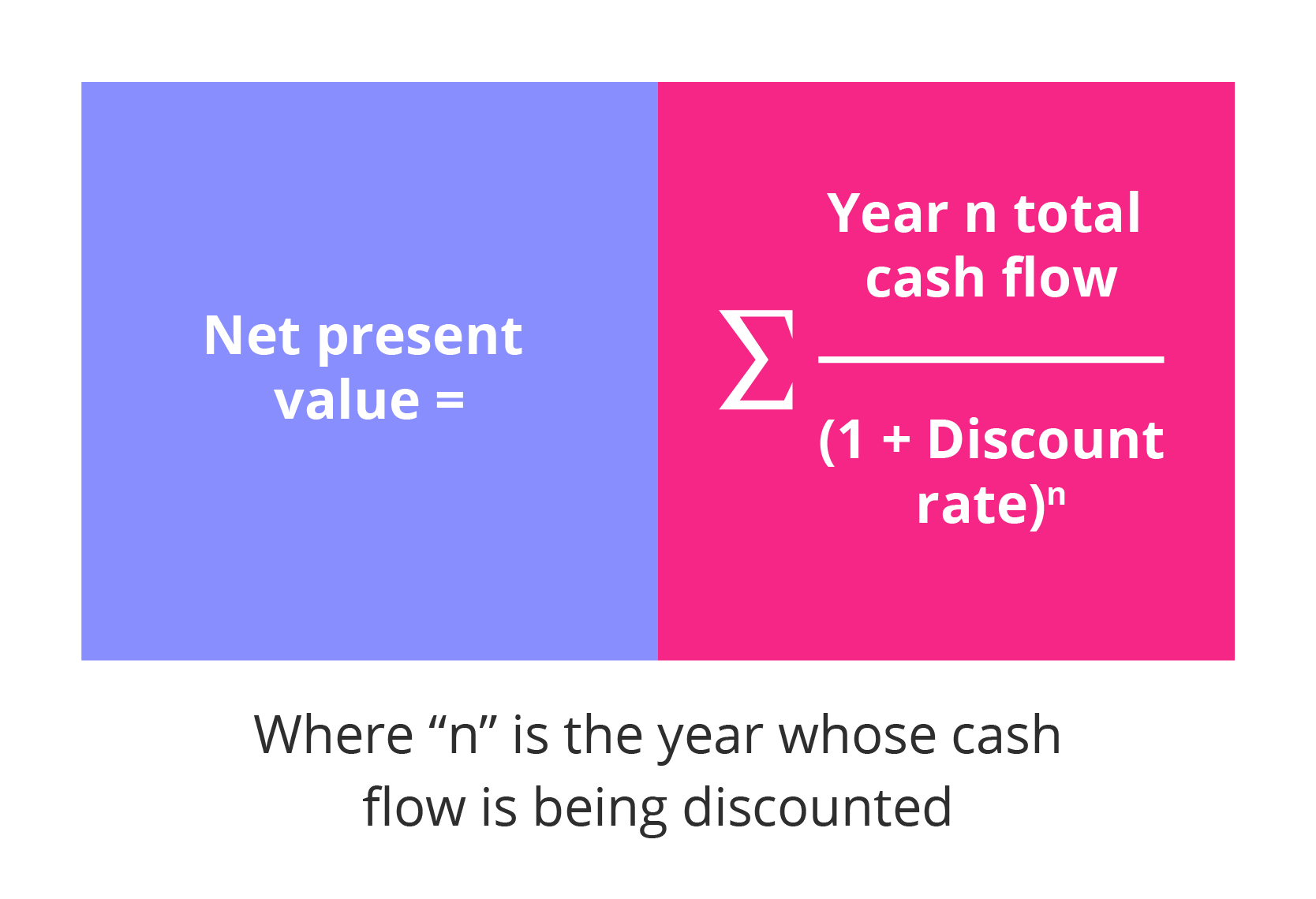

- Net present value (NPV).8 NPV shows the difference in the current value of cash and the value that cash will have in the future, or the sum of the present cash flow value (both positive and negative) for each year associated with the investment, that is then discounted so that it is expressed in today’s currency value. In project management, this is used to calculate whether the expected profit of a project will outweigh the present-day investment costs. NPV is calculated as follows:

- Internal rate of return (IRR).9 The IRR method of financial analysis factors in the time value of money, allowing the project manager to find the interest rate that matches the expected financial returns from the project. Once this rate is known, it can be compared against rates that might be earned from investing elsewhere to determine if this is a financially viable project

Here is a short list of some useful project management apps and online tools that allow for project cost estimation, such as time- and budget-tracking functionality, that can help to produce more accurate project estimates.

- Microsoft Excel:10 Widely used project cost estimator tool, with plenty of project estimate templates

- Google Sheets:11 Free project cost estimation tools alternative to Excel

- Price&Cost:12 SaaS (an online software subscription) estimating and cost management tool to manage project financials

- Eastimate:13 Free SaaS estimation tool to create estimates and timelines collaboratively

- Simplestimate:14 Free project cost estimator SaaS tool with three-point cost estimation and easy sharing

Create a project estimate

Once the project has been deemed viable through the cost benefit analysis process, an estimate needs to be done at the start of the project and can be done by using the following estimate models:

- Time and materials.15 This type of estimate is useful when it is difficult to estimate the complete scope of the project, and so the focus is placed on time spent and materials used

- Fixed price estimate.16 This is a total fixed price for the project, regardless of the amount of effort applied to the project

- Reserve analysis.17 This is where some budget is set aside for unforeseen overruns or risks

- Cost of quality.18 This is the amount of money it will take to ensure the project is done right; checking for bugs or errors during the project, and correcting them, over and above the time and materials costs

Monitor the project progress

The project manager needs to identify when costs deviate from the budget, and manage those deviations, by regularly comparing the money spent with the budgeted amount, and reporting this back to key stakeholders.19 Establishing an understanding of how this progress will be measured and reported is important.

- Earned value analysis (EV).20 A widely-used method by project managers, EV allows for the periodical comparison of the budgeted costs with the actual costs during the project. It joins the scheduled activities of the project with detailed cost estimates for each activity, and makes provision for the partial completion of an activity, where some of the associated costs have been paid, and others not

- Budget timeline.21 Costs are linked to project milestones, with each activity having a start and end date. Therefore, it is possible to determine how much money will be spent by a particular date during the project. This allows for project capital to be deposited in strategic intervals throughout the project in order for finances to be made available, and managed, against the activities schedule

- Schedule variance (SV).22 The project manager needs to know if the project is within budget against the time schedule. The difference between the planned schedule and actual progress is the SV. The SV is the difference between the EV and the planned value (PV), shown as SV = EV − PV. If EV is below what was budgeted, then the SV will be negative, which means the project is running behind schedule

The post-project analysis

Once the project is complete, a post-project financial analysis should take place to determine how profitable it was. Profit margin measures the profit of a project relative to its revenue, and has three main profit margin metrics:23

- Gross profit margin. This is total revenue less the project costs, like time and materials.

- Operating profit margin. This measures revenue less project costs with operating expenses.

- Net profit margin. This is revenue less all expenses, including interest and taxes.

When comparing the actual profit or loss of the project against the initial estimate that was carried out at the beginning of the project, variances may become apparent. A variance analysis is the investigation of the difference between what actually happened as opposed to what was planned, and studies why these variances occurred.24

If the project was deemed a financial failure with a negative profit margin, it is easy for project managers to fall into one or both of these fallacies:25

- The ‘sunk cost fallacy’. This is when project managers or stakeholders believe that, if more money is invested into a failed project, it will recover. However, this typically leads to financially catastrophic results.

- The ‘commitment fallacy’. This is where people are so committed to a project that they will not admit defeat, to the point of damaging their finances, reputation, and company.

Successful project managers know when to admit that a project is a financial loss, and learn from the failures and mistakes. Many project managers conduct a ‘lessons learned’ review at the end of every project for this very reason. The knowledge and experience gained from previous projects will prove highly valuable to the success of projects to come.

Knowing how to do a financial analysis before, during, and after a project is a key skill set that project managers in every sector of business need if they wish to make sound project viability decisions, and ensure the project is carried out on time, within scope, and within budget.

Learn how to approach and execute projects more effectively and efficiently with a Project Management online short course.

- 1 (May, 2018). ‘Why is budgeting such an important part of project management?’. Retrieved from Clarizen.

- 2 Tuovila, A. (Oct, 2019). ‘Financial analysis’. Retrieved from Investopedia.

- 3 Bunner, A. (May, 2017). ‘How to manage project budgets: four tips’. Retrieved from Clarizen.

- 4 Landau, P. (Jun, 2018). ‘Cost benefit analysis for projects – a step-by-step guide’. Retrieved from Project Manager.

- 5 Sahan Buwaneka De Silva, K. H. (Nd). ‘Project financial analysis package’. Retrieved from Project Management. Accessed 5 June 2019.

- 6 (Nd). ‘Financial analysis of major projects’. Retrieved from BizFilings. Accessed 5 June 2019.

- 7 (Nd). ‘Financial analysis of major projects’. Retrieved from BizFilings. Accessed 5 June 2019.

- 8 (Nd). ‘What is net present value (NPV) in project management?’. Retrieved from Wrike. Accessed 5 June 2019.

- 9 (Nd). ‘Financial analysis of major projects’. Retrieved from BizFilings. Accessed 5 June 2019.

- 10 (Nd). ‘Microsoft Excel’. Retrieved from Microsoft Excel. Accessed 5 June 2019.

- 11 (Nd). ‘Google Sheets’. Retrieved from Google Sheets . Accessed 05 June 2019.

- 12 (Nd). ‘Price and cost’. Retrieved from Price and Cost . Accessed 05 June 2019.

- 13 (Nd). ‘Eastimate’. Retrieved from Eastimate . Accessed 05 June 2019.

- 14 (Nd). ‘Simplestimate’. Retrieved from Simplestimate . Accessed 05 June 2019.

- 15 Aston, B. (May, 2019). ‘Create a project budget that works: the complete cost estimation guide’. Retrieved from The Digital Project Manager.

- 16 Aston, B. (May, 2019). ‘Create a project budget that works: the complete cost estimation guide’. Retrieved from The Digital Project Manager.

- 17 Watt, A. (Nd). ‘Budget planning’. Retrieved from BC Campus. Accessed 05 June 2019.

- 18 Watt, A. (Nd). ‘Budget planning’. Retrieved from BC Campus. Accessed 05 June 2019.

- 19 Watt, A. (Nd). ‘Budget planning’. Retrieved from BC Campus. Accessed 05 June 2019.

- 20 Wiley, et al. (Nd). ‘Project management for instructional designers’. Retrieved from PressBooks. Accessed 05 June 2019.

- 21 Wiley, et al. (Nd). ‘Project management for instructional designers’. Retrieved from PressBooks. Accessed 05 June 2019.

- 22 Wiley, et al. (Nd). ‘Project management for instructional designers’. Retrieved from PressBooks. Accessed 05 June 2019.

- 23 (Nd). ‘Profit margin’. Retrieved from Corporate Finance Institute. Accessed 05 June 2019.

- 24 (Dec, 2018). ‘Variance analysis’. Retrieved from Accounting Tools.

- 25 Bridges, J. (Jun, 2019). ‘How to know when to kill a project and cut losses’. Retrieved from Project Manager.