How Fintech Has Affected the Wealth Management Sector

Fintech has been driving trends in the wealth management industry since the 1980s, thanks to the emergence of e-trading and online banking. But owing to recent advances, wealth management – like every aspect of the modern finance world – is currently experiencing profound disruption. The surge in investment in fintech has cascaded into investment in financial technologies. In 2020, global spending on fintech reached $121.5 billion.1 This is a marked increase from the 2015 global spend of $20 billion.2

Traditionally, wealth managers offer a broad range of professional financial services, from investment advice to general financial planning. Essentially, these multiskilled advisors guide those looking to manage their portfolios and finances.3 Now, fintech – the application of technology in the financial sector – makes its presence felt by creating digital solutions that transform the investment asset management industry.4 However, this change heralds new opportunities in the future of wealth management.

Wealthtech: the future of wealth management

Fintech enables wealth managers to improve their service, giving rise to an entirely new skill set: wealthtech. Often driven by artificial intelligence (AI) and machine learning (ML), wealthtech leverages complex algorithms to advise clients on the best investment or savings plans, with minimal human intervention.5

This technology is being used in diverse ways:

Robo-advisors

These online applications take on the role of human advisors in fintech wealth management by using algorithms to calculate and select investments based on prospective clients’ desired risks and objectives. As a result, they’re typically able to fulfill the same role as a wealth manager but at a lower cost. Robo-advisors spread portfolio management costs over many customers and require less human interaction, making them a less expensive option.

But there are some drawbacks. In practice, the robo-advisors offer defined but fewer choices in how to invest money. A wealth manager, in contrast, encourages client input – they might, for example, avoid investing in specific markets you consider problematic.6

Robo retirement planning platforms

Essentially a subcategory of robo-advisors, these digital platforms specifically focus on retirement investments. Like robo-advisors, they have limitations. They use algorithms to recommend investments based on a client’s desired outcomes and risk profile, and there are restrictions when it comes to customizing their portfolio. For example, clients won’t be able to tailor their investment portfolio to focus on specific companies nor will they enjoy personal human interaction with an advisor that keeps specific preferences in mind.7

Micro-investing

Fintech companies have been trying to demystify investing for customers and develop simpler, low-cost ways of generating greater financial reward without an initial costly investment. Today, this is achieved by allowing customers to invest small amounts of money over time through micro-investing. Typically, customers are charged a small subscription fee instead of the usual management fees in wealth management.8 Unfortunately, sometimes the initial investment amount is small enough that the fees (while not significant themselves) cannibalize enough of the initial amount to make the investment seem futile.

Many micro-investing platforms operate on a “spare change” basis, allowing individuals to invest a small amount calculated by rounding up purchases made on a client’s debit card to the nearest dollar. This means that even if the subscription fee is low, investors could ultimately pay an effective five percent commission fee – and this number increases once the account grows past a certain point.9

However, micro-investing platforms offer an attractive prospect for new investors who may be reluctant to invest in more expensive options, which often require a larger initial capital input.10

Self-investment tools

A number of different tools and platforms can help investors to invest their money themselves. These programs and platforms can be used independently or collectively, enabling individuals to invest their money as they see fit – assuming they know what they’re doing.

These self-investment tools are essential for wealth management:11

- Digital brokerages facilitate access to stock-market information and investment

- Investing tools allows one to conduct investment research and make stock comparisons

- Portfolio management software makes it easier to track and manage investments in a single, unified platform

- Financial services software generally acts as a middleman of sorts. For example, these applications interface between financial applications and users’ bank accounts

If you’re interested in learning more, the FinTech online short course offers a contemporary overview for business decision-makers, financial professionals, and senior management professionals to navigate the transformed financial services industry with ease.

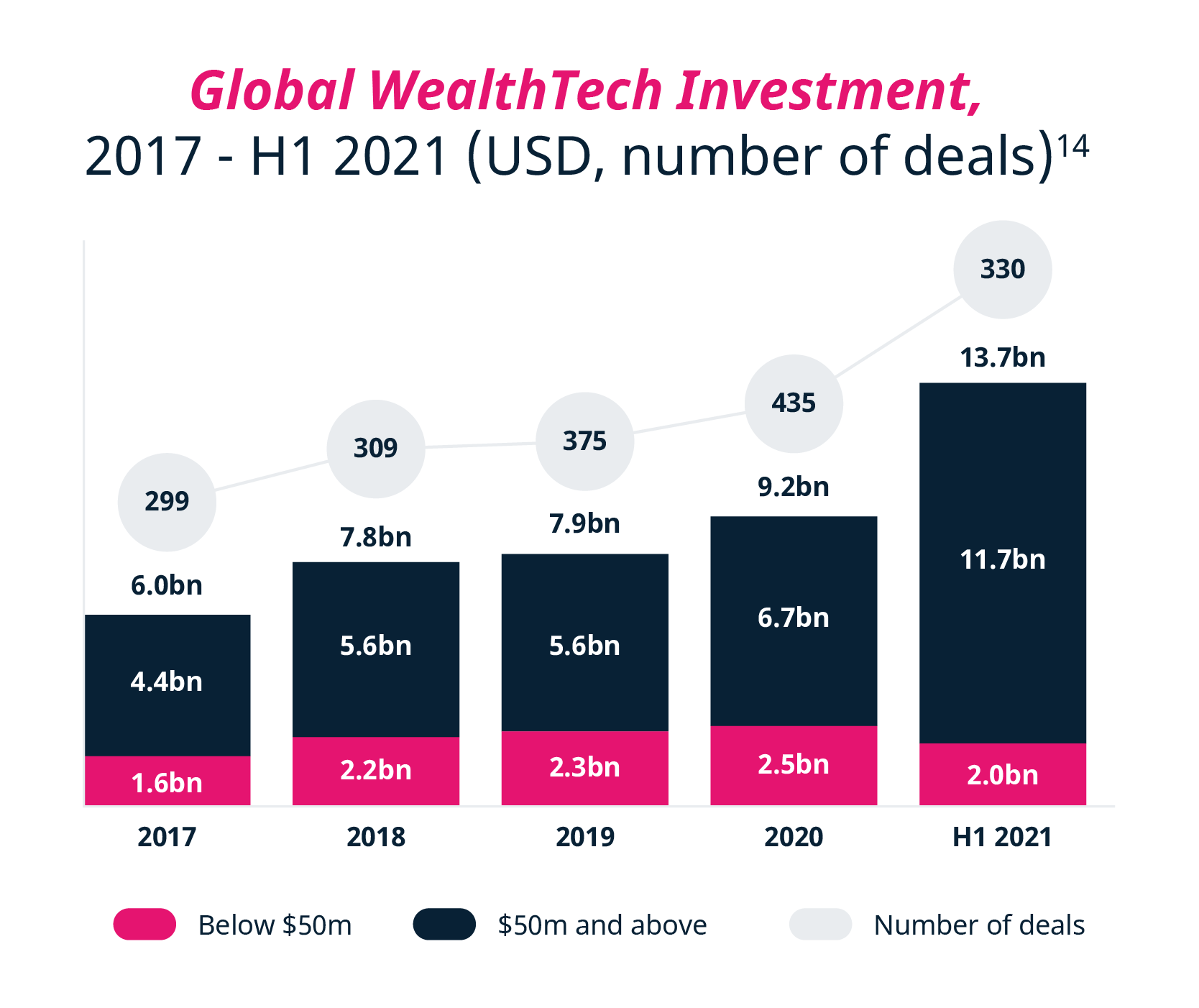

The relatively low cost of entry makes wealthtech an attractive investment for fintech start-ups, because they’re able to market wealth-management services to clients at lower prices. As a result, customers can access markets that they would previously have considered wealth-management services unattainable.12 The growth in this fintech sub sector has been rapid, with global wealthtech funding setting a new record in 2021 after $13.6 billion was raised in the first six months of the year.13

Practical fintech applications in wealth management businesses

Wealth management professionals can now leverage fintech solutions to potentially reduce the cost of entry for their clients. In a fintech-driven world, personalization is the key to success. While robo-advisors can provide support, the interactions are frequently insufficient.

Wealth management companies who successfully combine the technological advantages of robo-services with personal interactions can distinguish themselves in the sector.15 By leveraging AI solutions to perform behind-the-scenes operations such as data entry and active investment management, wealth managers can focus on their clients’ specific needs.16

To ensure their own prosperity and that of their clients, wealth management firms need to consider the role of fintech applications in scaling their practices and define new efficiencies that provide symbiotic benefits to themselves and their clients. By exploring dynamic methods of wealth management, advisors and wealth managers can realize financially sustainable practices in the fintech age.17

There are vast opportunities with applying innovation practically, but it requires engaging with relevant content and training programmes focused on disruptive technologies. With the FinTech online short course, business leaders and professionals alike will discover how to apply new developments strategically.

- 1 Oct, 2021). ‘Fintech – statistics and facts’. Retrieved from Statista Research Department.

- 2 (2015). ‘FINTECH 100 – Leading global fintech innovators report 2015’. Retrieved from KPMG. Accessed 22 December 2021.

- 3 Ganti, A. (Jun, 2021). ‘Wealth management’. Retrieved from Investopedia.

- 4 (Mar, 2021). ‘What is wealthtech?’. Retrieved from Storm2.

- 5 (Mar, 2021). ‘What is wealthtech?’. Retrieved from Storm2.

- 6 Rosenberg, E. (Apr, 2021). ‘Robo advisors vs. financial advisors – which one should you use?’. Retrieved from Investor Junkie.

- 7 Rosenberg, E. (Apr, 2021). ‘Robo advisors vs. financial advisors – which one should you use?’. Retrieved from Investor Junkie.

- 8 Maddox, C. (Dec, 2021). ‘The pros and cons of “spare change” investment apps’. Retrieved from Money under 30.

- 9 Maddox, C. (Dec, 2021). ‘The pros and cons of “spare change” investment apps’. Retrieved from Money under 30.

- 10 Maddox, C. (Dec, 2021). ‘The pros and cons of “spare change” investment apps’. Retrieved from Money under 30.

- 11 (Mar, 2021). ‘What is wealthtech?’. Retrieved from Storm2.

- 12 Khartit, K. (Dec, 2020). ‘How fintech is disrupting wealth management’. Retrieved from Investopedia.

- 13 (Jul, 2021). ‘Global wealthtech funding sets a new record in 2021 after $13.6bn raised in the first six months’. Retrieved from Fintech Global.

- 14 (Jul, 2021). ‘Global wealthtech funding sets a new record in 2021 after $13.6bn raised in the first six months’. Retrieved from Fintech Global.

- 15 McNamee, P. (Nov, 2021). ‘The future of wealth management: the disruptive forces shaping the industry’. Retrieved from Finextra.

- 16 McNamee, P. (Nov, 2021). ‘The future of wealth management: the disruptive forces shaping the industry’. Retrieved from Finextra.

- 17 Khartit, K. (Dec, 2020). ‘How fintech is disrupting wealth management’. Retrieved from Investopedia.