How Decentralised Exchanges Will Affect the Cryptocurrency Market

As a relatively new development in the world of cryptocurrency, decentralised cryptocurrency exchanges solve many of the more pressing issues faced by centralised exchanges, such as trust, security, high trading fees, and the need for personal documentation.1 The cryptocurrency landscape is evolving and gaining strength, but is lagging as far as regulations are concerned. But what are decentralised exchanges, and how are they likely to affect the cryptocurrency market?

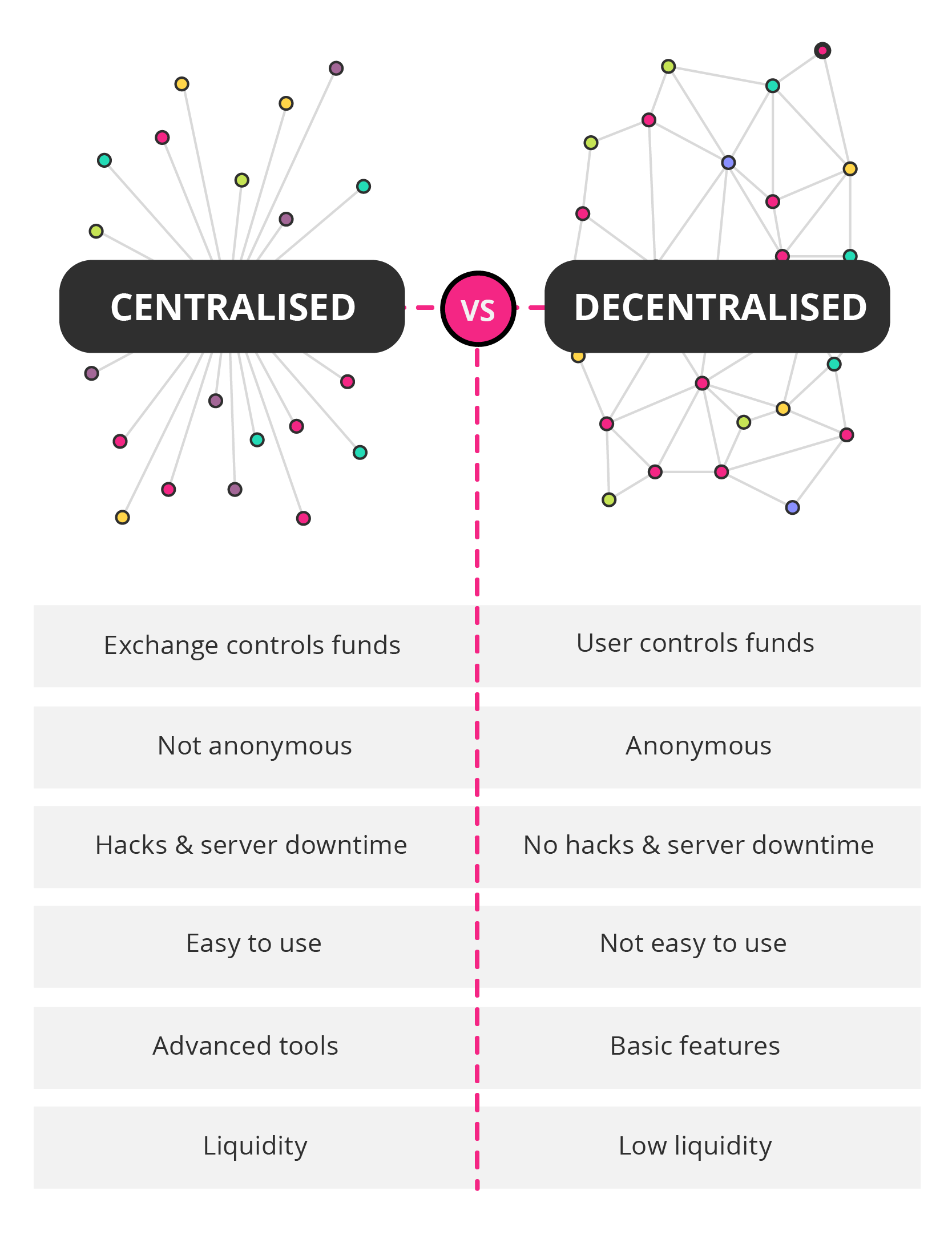

Decentralised exchanges and how they differ from centralised crypto exchanges

Centralised cryptocurrency exchanges (CCEs) have, until now, been the primary platforms for trading cryptocurrencies. CCEs work in a similar way to stock markets, where a CCE will be owned and operated by a single organisation that has full control over all transactions.2 CCEs make use of middlemen or intermediaries, much as we’d use and trust a bank to manage our financial assets. These middlemen act like stock brokers and they conduct transactions and trades for users.3 CCEs are where order reviewing, matching between users, routing, and execution of order transactions through exchange software and servers, take place.4

CCE users do not have access to the private keys of their exchange wallet’s account (the software programmes used to handle key management) but rather access it through a process called custody, which refers to who holds the keys to accounts on the exchange.6 Currently, 99% of trading volume take place on centralised exchanges, with 73% being custodial.7 For example, when you buy cryptocurrency, like Bitcoin, it will appear in your account. However, you don’t own it and cannot manage it yet as it’s in ‘custody’. To gain control, you need to request a transfer of that cryptocurrency to your external wallet address from your exchange provider or middleman. That means that transactions can only be processed through the verified operators within the exchange, and approved by a central authority.

Decentralised cryptocurrency exchanges (DEXs), much like cryptocurrencies, are not owned or operated by a single company.8 DEXs don’t keep custody of customers’ funds, positions, or information, but serve only as a matching and routing layer for trade orders. There is no need for an exchange or intermediary institution to manage the ledger or control user funds.9 Rather, DEXs allow trades to take place directly between users in a peer-to-peer manner, with the help of an automated process.10

They allow non-custodial exchanges, which means that users can keep all the funds in their wallets and independently request and allow trades from their wallet. The DEX in this instance is the matching service.

The main benefit of DEXs is that you’re not dependent on the protocols of the exchange or third party, because you hold the funds in your personal wallet.11 It’s also more private, as users don’t have to surrender their personal details to an organisation and can trade anonymously if they prefer. Additionally, DEXs are at no risk of server downtime, as hosting is distributed throughout the nodes, or people, involved in the exchange. And are less vulnerable to being hacked than CCEs.

However, there are pros to using centralised exchange, they are easier to use, have access to more advanced tools, and have high liquidity.12

The potential for DEXs

According to DappRadar, a website that ranks the top decentralised applications (DApps) by users, volume, and transactions, DEXs are proving to be among the most popular decentralised application choice for users.13 DApps (pronounced D-Apps) are open-source computer applications that run on a blockchain technology, or a ledger, and don’t require a middleman to manage user information, or to function.14 The ethereum white paper categorises DApps into three types: DApps that only work with currency, DApps where money is involved but are also dependent on external information, and DApps that fall into the ‘other’ category, which includes governance systems and voting.15 According to DappRadar, DEXs are proving to be the dominant DApp where currency is concerned, by both the number of users and by volume.

With more formal regulations on cryptocurrencies approaching, the technology that supports DEXs is constantly developing in order to maintain the privacy and independence of users.16 When it comes to a non-custodial, private and secure means to trade cryptocurrency, the trend towards decentralisation in cryptocurrency exchanges is clearly supported by users. This is most evident on Bisq, one of the open-source desktop applications through which users can trade cryptocurrency for traditional fiat currencies or altcoins (other cryptocurrencies) in a decentralised manner.17

The impact on the cryptocurrency market

Cryptocurrencies have revolutionised traditional finance through the new opportunities for value trading – without the need for formal banking institutes. As of May 2019, data site Cryptocoin Charts indexed 5,442 crypto currencies, with $171.41 billion market capitalisation.18 According to a recent study by Cambridge University, the current number of total crypto user accounts is now over 139 million, with an estimated minimum of 1,876 people employed full-time in cryptocurrency companies – most of whom are in the exchanges sector.19

Due to blockchain technology, the need for a central institution is removed, as the transparent ledger platform allows individuals to trade with trust. However, to enter the cryptocurrency ecosystem, cryptocurrency first needs to be purchased using fiat currency, such as dollars, or euros. This is ironically done through a centralised institution, such as Coinbase or Kraken, two of the major cryptocurrency exchanges, who require personal information and manage your accounts.20 In other words, the only way to enter a non-custodian, decentralised ecosystem, is to pass through a centralised institution. Despite this, the benefits provided by DEXs of offering users alternative ways to find one another, and trade directly on-chain, are making them increasingly popular.

DEXs still face major technical challenges, and complete decentralisation may not be entirely possible at this point.21 However, a hybrid model may be the best way forward, where the benefits of a centralised exchange, such as its speed and policies, are combined with the security, privacy and non-custodial nature of decentralised exchanges. Either way, the technology and development behind DEXs will impact how cryptocurrencies are traded. As financial technology continues to develop and evolve, DEXs are sure to bring cryptocurrency trading closer to being fair, private, and independent.

Gain practical knowledge of the latest cryptocurrency developments and the skills to assess the viability of crypto projects with the MIT Media Lab Cryptocurrency course.

- 1 (Jun, 2018). ‘Four problems with centralized exchanges’. Retrieved from CryptoDisrupt.

- 2 (Jun, 2018). ‘Decentralized vs centralized exchanges: advantages and disadvantages’. Retrieved from Hacken.

- 3 Skraba, Z. (Dec, 2018). ‘Fundamentals of centralised and decentralised exchanges’. Retrieved from Krimptomat.

- 4 Garner, B. (Aug, 2018). ‘What is a DEX? Decentralised exchanges, explained’. Retrieved from CoinCentral.

- 5 Rauchs, M. Et al. (Dec, 2018). ‘2nd global cryptoasset benchmarking study’. Retrieved from Cambridge.

- 6 Garner, B. (Aug, 2018). ‘What is a DEX? Decentralised exchanges, explained’. Retrieved from CoinCentral.

- 7 Goldenberg, T. (May, 2018). ‘Watch out crypto exchanges, decentralisation is coming’. Retrieved from CoinDesk.

- 8 (Jun, 2018). ‘Decentralized vs centralized exchanges: advantages and disadvantages’. Retrieved from Hacken.

- 9 Garner, B. (Aug, 2018). ‘What is a DEX? Decentralised exchanges, explained’. Retrieved from CoinCentral.

- 10 Skraba, Z. (Dec, 2018). ‘Fundamentals of centralised and decentralised exchanges’. Retrieved from Krimptomat.

- 11 Madeira, A. (Mar, 2019). ‘What is a decentralized exchange?’. Retrieved from CryptoCompare.

- 12 OKex. (Mar, 2019). ‘Is decentralised exchange (DEX) becoming the new norm?’. Retrieved from Medium.

- 13 (Nd). ‘Dapp rankings’. Retrieved from DappRadar. Accessed 2 May 2019

- 14 Hertig, A. (Nd). ‘What is a decentralized application?’. Retrieved from Coindesk. Accessed 14 May 2019

- 15 (May, 2019). ‘White paper’. Retrieved from GitHub.

- 16 Vilner, Y. (Dec, 2018). ‘The state of decentralised exchanges and plans for 2019’. Retrieved from Forbes.

- 17 (Oct, 2018). ‘Bisq volumes reach all time highs as Monero demand spikes’. Retrieved from The Block.

- 18 (Nd). ‘Coin Market’. Retrieved from Coin Market. Accessed 2 May 2019

- 19 Rauchs, M. Et al. (Dec, 2018). ‘2nd global cryptoasset benchmarking study’. Retrieved from Cambridge.

- 20 Garner, B. (Aug, 2018). ‘What is a DEX? Decentralised exchanges, explained’. Retrieved from CoinCentral.

- 21 Garner, B. (Aug, 2018). ‘What is a DEX? Decentralised exchanges, explained’. Retrieved from CoinCentral.